A loans for housing construction is one of the types of housing loans that exist, offered by banks and that allow from buying, remodeling to building your own house. Housing loans allow families, couples or singles to be able to pay for the house over a period of several years, based on the punctual and monthly payment of the loan, the amount of the housing loan will depend on the income of the applicant. Housing loans are also used for the construction and remodeling of homes.

What aspects to consider when applying for a home loan?

When applying for a construction loan there are certain aspects to take into account and that is key information, such as the interest rate and monthly costs, as well as knowing the monthly fee that allows you to know if you can pay it without setbacks each month. Knowing all this information will help you find the best home loan to buy your own home.

Below we will bring you the best loans for home construction, with the most important details of each of them: the interest rate, the value of the installment for a loan of 200,000,000 pesos, along with the value of insurance mandatory to contract during the life of the loan, and the maximum financing percentage.

Mortgage Credit for Housing Construction – Bancolombia

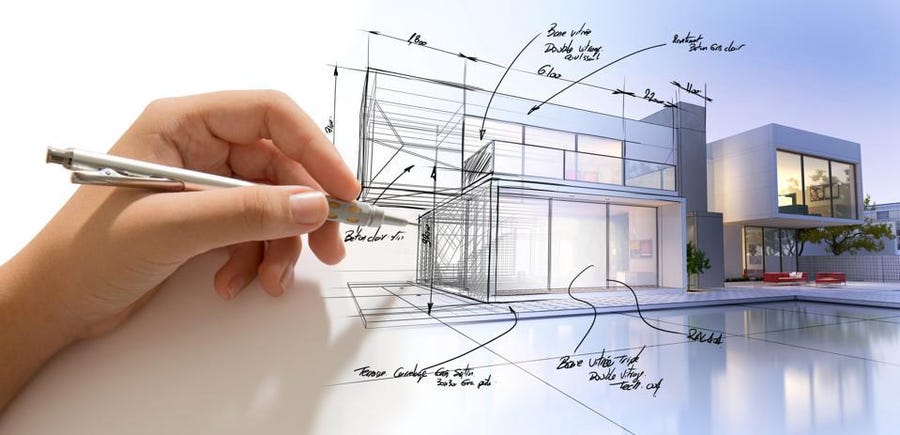

Bancolombia offers the credit for construction to pass the plans and images that the architect shows you to the house that you can inhabit with your family.

Characteristic:

- For ages between 18 and 72 years.

- Income of the main debtor minimum 2 SMMLV.

- Value of the house to be built minimum 135 SMMLV.

- Term is between 5 and 20 years.

- The construction must be carried out in a maximum of 12 months, 2 disbursements will be made according to the progress of the work verified in the views of the expert.

Housing Construction Credit – BBVA

BBVA has a construction loan so you can build the home you’ve always dreamed of.

Characteristic:

- Finance up to 70%

- Manage fixed rates and installments throughout the duration of the loan.

- Flexible terms from 5 to 20 years.

- You can make the payment from accounts of other banks through PSE.

- Schedule the payment of your installments through automatic debit to your BBVA AFC, savings or checking account.

- Aimed at people between 18 and 74 years old.

- Request your credit from $150 million.

- You can consolidate family income between spouses, parents with single children, or between single siblings to improve ability to pay. The minimum consolidated income must be $6 million.

Loan for the construction of own housing- Banco de Occidente

Banco de Occidente’s own home construction credit finances the construction of your home on a plot of land that you own.

Characteristic:

- Finance up to 80% of the property’s appraisal.

- Term from 5 to 20 years.

- Minimum financing amount of $50,000,000

- It is not mandatory to purchase other products with the Bank.

- Accompaniment throughout the financing process.

- Accept prepayments at any time without any penalty.

- It offers a broad insurance portfolio for the applicant and their home.

Loan to build housing- Banco Caja Social

Banco Caja Social offers credit to build on your own site, this credit has been create thinking of natural persons who acquire a lot to build a single-family home.

Characteristic:

- It allows access to the resources for the execution of the individual construction project, so that it is carried out according to the desired designs and in the foreseen time.

- Applicant’s minimum income: family income from 12 SMMLV.

- Minimum credit amount: 300 SMMVL.

- Disbursements are schedule as the work progresses.