[ad_1]

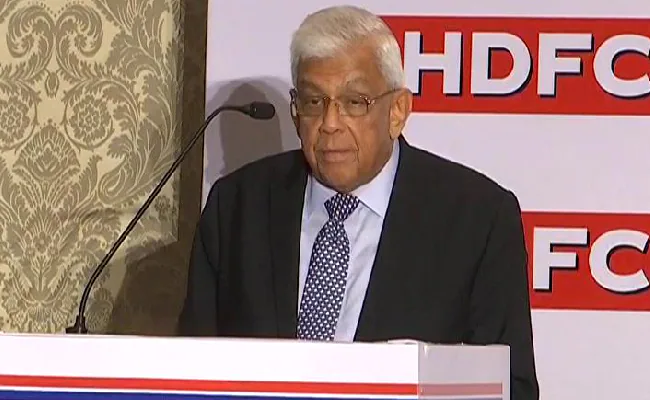

HDFC’s Deepak Parekh said unusual measures were taken because of the unusual times.

Mumbai:

HDFC Chairman Deepak Parekh on Thursday said the largest pure-play home financier may face a compression of its Net Interest Margin (NIM) in the short term as it is unable to immediately pass on the impact of RBI’s rate hike to borrowers.

Parekh, however, exuded confidence that the spreads and margins which the corporation makes on loans sold by it will stabilise over the medium to long term.

It can be noted that the RBI has hiked interest rates by a cumulative 0.90 per cent in two successive actions since May with an eye to tame the rising inflation, as it tries to rollback the accommodative measures taken during the pandemic.

Parekh said the impact on the NIM, which stood at 3.5 per cent for the March quarter and 3.7 per cent for June 2021 quarter, will be for a “quarter or so”.

“The manner in which interest rates have moved resulted in some transmission lag and this may have a short term impact on margins, largely in comparison with the corresponding quarter of the previous year,” Parekh said addressing HDFC’s shareholders at its Annual General Meeting (AGM) conducted virtually.

“When the RBI increases the interest rates, our cost of borrowing goes up immediately, but there is a few months’ lag before we can increase the interest rates,” he said.

Replying to shareholders’ queries, he said HDFC had explored the possibility of listing its insurance subsidiary HDFC Ergo, but it’s German partner feels it is not the right time, so there are no plans to go for the IPO anytime soon.

Parekh said a slew of factors augur well for India’s growth at present, but the mood is “sombre” because of the volatility in the equity markets.

The risk-averse foreign portfolio investors are selling aggressively to cover for losses they are booking in other emerging markets, which has led to the difficulties, he said.

Fortunately for the country, the increased interest from domestic institutional investors and retail investors has helped support the equity markets, Parekh, a veteran of the financial services space, said.

The positives which augur well for the economy, which is projected to grow at over 7 per cent, are government’s commitment to higher capital expenditure, food security and capacity utilisation touching 75 per cent which portends the beginning of a new private capex cycle, he said.

Parekh said unusual measures were taken because of the unusual times that we passed through, and the same are currently being withdrawn in a calibrated manner, and seemed to welcome the RBI and government acting in tandem.

Indian inflation, which has been consistently breaching the RBI targets, is not because of excess demand but is attributable to the supply side issues emanating from surge in oil prices due to the geopolitical tensions, Parekh said, exuding confidence that price rise will trend downwards once the current problems ease.

In such a context, there is an immense demand for housing in the country which will also translate into demand for home loans, Parekh said, pointing out that in March this year, HDFC witnessed the highest demand for a single month in its history.

Parekh said a separate meeting will be arranged for shareholders’ approval for merging the corporation with HDFC Bank, and requested shareholders to show patience at Thursday’s AGM, and address questions regarding the merger at the special meeting to be held subsequently.

The merger, which was announced in early April, requires a series of approvals from financial sector regulators, including RBI and IRDAI, he said.

The company’s management has been advised by the lawyers not to speak about the merger at the AGM. With the merger ratio being already decided, there is no way that requests like a bonus or rights issue of HDFC shares can be considered, Parekh said.

He further said that applications have been made to Competition Commission of India, Reserve Bank of India and Sebi for the merger, and it will take up to 15 months for it to be completed.

All the HDFC employees will be absorbed by the bank as there is hardly much of duplication between the two entities, Parekh said, adding that the bank will also take over the liabilities like the over Rs 1,800 crore of masala bonds, deposits etc and pay as per decided terms.

Terming the merger as a positive step in the best interest of both the institutions, Parekh said a request has also been made to the RBI to make HDFC’s current subsidiaries a part of HDFC Bank as subsidiaries.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

[ad_2]

Source link